Communities big and small agree that comprehensive planning (i.e., your 5-10-20 year plan for land use and development) is important to envisioning and preparing for the future. But, for many created plans, the question remains: “How will you build that future?”

At its simplest, the underlying answer is that comprehensive plans must shift from theoretical to practical – especially in light of tax levy growth constraints, public push back against higher taxes, pressure from nearby communities, and a time of economic uncertainty.

Traditionally, comprehensive planning has been about land use development potential, with some attention paid to implementation and even less to the plan’s financial, tax levy, or tax rate impacts on taxing units and taxpayers. The new generation of municipal planners are well-versed in both land and financial impacts, in addition to finding the dollars you need to pay for public investments.

Below, we highlight four components that today’s comprehensive plans should always include to show the “complete picture” of planning initiatives. Specifically, how these perspectives can help municipalities join this new generation, create the best likelihood their plans will be implemented, and foster community and economic development for more vibrant, prosperous communities.

1. Uncover the anticipated expense (cost of community services) for each land use type classification

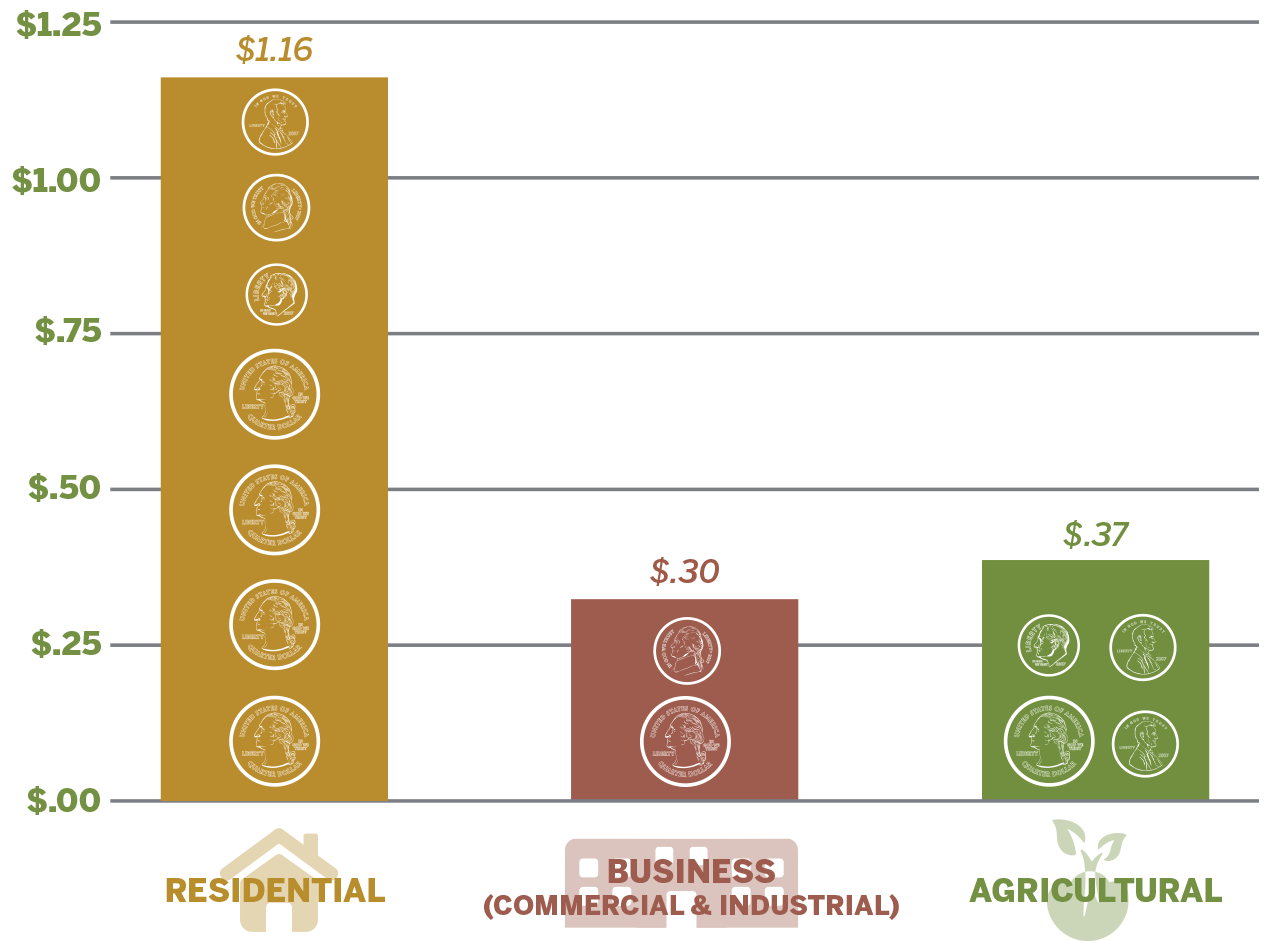

A cost of community services study (COCS) determines whether various forms of land use contribute to or detract from local government budgets, an important consideration when developing and preparing a comprehensive plan at any level (municipal, township, or county). More specifically, COCSs help uncover the fiscal contribution of existing local land uses by providing a baseline of information that assists local officials and citizens in making informed land use and policy decisions.

COCS analyses should be an important precursor to comprehensive planning to understand the land use relationships and achieve near tax neutrality (i.e., will not raise taxes for residents). As an example, comprehensive planning committees can use the results from a COCS analysis to proactively consider the cost (or tax levy impact) of public services for each of their land uses:

- Residential (by housing types – single-family, two-family, multi-family, etc.)

- Business (by commercial, industrial, and private utility)

- Agricultural (by farmland and open space)

From here, they can develop a land use development strategy that works for everyone based on anticipated tax levy impacts to determine future land use development allocation for residential, business, and agricultural projects that are acceptable to not only the elected officials but also the community’s residents (as taxpayers). One of the most common procedures for analyzing this fiscal impact, as part of a COCS study, is to calculate a ratio for each of the above land use categories.

A ratio greater than $1.00 suggests that, for every tax dollar of revenue collected from a given category of land, more than one dollar is spent on public services to that land use type – demonstrating a net drain on local government budgets and the need to increase tax levies to meet this increase in service demands.

Good planning will necessitate COCS studies and provide municipalities with an informed and thorough tool to make decisions about their futures – resulting in potential long-term tax savings regarding comprehensive planning and implementation success. These “savings” also include fewer disgruntled residents, stakeholders, and developers due to unintended tax hikes, fewer delays due to unfunded public projects or gaps in municipal budgets, and halted implementation of an approved comprehensive plan.

2. Consider the role of economic development, financial incentives

Community development and economic development are often used together to describe the efforts of building a better community. These terms have similarities, but the processes and results are very different. Where the two differ is explained well by the Fort Collins Area Chamber of Commerce:

Nearly every community in America touts its ‘great quality of life.’ Some Fort Collins leaders contend that all the community needs to do is focus on being a great place (community development) and the economic part will simply take care of itself. On the contrary, for a community to be economically viable, it must make a concerted effort to work on both community development and economic development. They are interdependent and reinforce each other.

It is important to recognize that economic development and community development are not the same. Community development is a process for making a community a better place to live and work. Economic development is purely and simply the creation of wealth from which many community benefits result. While important to creating a vibrant economy, community development does not factor in important business fundamentals necessary for the successful, sustained operation of businesses. Communities still must make a basic business case to desirable prospective employers.

Community development can assist with identifying priorities and helping to partner with local officials and the community to develop a comprehensive plan. But economic development plays a pivotal role in uncovering where the dollars are going to come from, potential revenue sources to implement planning efforts, and the tax rate and levy implications of comprehensive planning decisions.

When preparing a comprehensive plan, if communities focus on community but not economic development, they limit themselves to a wish list of what may happen without the benefit of sound judgment. This can lead to creating a long-term land use plan for growth, but not having a quantifiable value to that plan – or, more simply stated, not understanding the who, what, where, why and to what extent the costs and tax implications will be to implement the plan, as well as the required public investment that will be needed to sustain its projected growth.

By performing a COCS analysis and undertaking economic development activities, municipalities have a better understanding of their potential funding sources, the tax implications, and the “costs” to implementing a comprehensive plan on the front end. They can also answer questions like:

- What financial incentives may be available, for how long, and for what type of development?

- Is Tax Incremental Financing (TIF) or tax abatement a potential financial incentive to consider?

- Can hybrid or creative financial incentives be developed to meet the needs of the community in order to implement a comprehensive plan and to guide strategic growth?

- Will the local government need to budget or issue general obligation debt, or provide public cost gap financing?

- Can the municipality establish impact fees to reduce the impact to current residents as a result of future land use development needs?

Looking to fund an upcoming project? Unsure of your options? All you need is 2-3 minutes with FundStart™. Provide us with a few pieces of insight, and we’ll connect you directly to an SEH expert and a list of potential funding solutions – often in the same business day and free of charge. Launch FundStart™

3. Prepare to update your plan every 5 years

The traditional comprehensive planning mindset has been to plan for 20 years. Many communities still stick to this concept, and with the right approach, it can work. But the reality is that many comprehensive plans become outdated at about the 5-year mark. Especially in light of fast-evolving federal, state, and local regulations, significant advances in technology (not only changing the projects communities need but how they’re done), and unplanned future costs from past projects.

If communities want to prepare a comprehensive plan that is more sophisticated and carefully weighs the growth of a community, they need to have a financial plan in place. They also need to carefully weigh the impact one project will have on the surrounding community, future projects, growth plans, impending law changes, etc.

Be proactive to stimulate or react to development trends. Comprehensive plans should consider how a community will extend public utilities (water, gas, electric, sewer, sanitary, and telecommunication infrastructure). They also need to consider if open space or parks are going to be involved – which then dovetails into potential park impact fees, infrastructure impact fees, and law enforcement impact fees, among others, as may be authorized by state statutes.

Ultimately, there’s a “cost” for implementing a comprehensive plan and a dollar value to all public capital improvement projects (from capital improvement plans, or CIPs) – each of which are necessary to pay for related land use development strategies and planned growth.

Communities need to uncover on the front end what these costs will be and how they plan for future land use development, as well as its public capital improvement, infrastructure, and costs. By supplementing comprehensive plans with a financial strategy and policy around each of these components, communities can set themselves up for sustained economic growth. Communities can also better budget and plan for capital improvements, prioritize projects, and weigh which projects will have the greatest impact on their viability under a CIP.

If a comprehensive plan is to extend longer than five years, the plan must have a clear approach to monitoring, evaluating, and reassessing its strategies, goals, and objectives to ensure a clear path to anticipated results. Also, the comprehensive plan must have a strong foundation that is consistent and aligned with your vision statement, mission statement, and 4-6 prominent yet cornerstone values. The bottom line, have a “Formula for Success” with strategies, goals, and objectives for processes to attain positive results; results that can be monitored, evaluated, and re-assessed regularly to remain the course among the winds of change.

4. Partner with adjacent communities upfront

When preparing a comprehensive plan, communities should always consider their adjacent municipalities. As neighboring communities grow, they consider or take action to annex the same property, which can stall projects and even create legal challenges that become costly to both communities. This can also delay projects and investments in public infrastructure.

For example, if one community is looking to annex five miles south while the community six miles south wants to annex four miles north, something will have to give (as illustrated in the graphic above). If not, the race to annexation, as well as land use sprawl, will begin – which is not efficient or sustainable for either community. In many cases, this can be worked out in a win-win scenario. Why? Each municipality is trying to offer services that enhance the lives of residents and businesses. Therefore, comprehensive planning should lift the quality of life for your region and neighboring communities.

Communities should proactively partner with their adjacent communities to address and negotiate what’s in the works and where to determine growth boundaries and cooperative annexation policies. Of course, resolution might not be easy. But at the very least, by having these conversations upfront, municipalities show their willingness to work together and desire to create a fully formed comprehensive plan.

In the end, compromise will save inefficient use of political capital and tax dollars in the interest of each adjacent municipality and may lead to additional cost-saving measures such as consolidation of public services and inter-local agreements, among others.

Tying it all together

The new generation of comprehensive planning hinges on proactively uncovering how we will pay for plan implementation (in addition to the individual projects necessary for the land use development strategy to be achieved), while laying the groundwork for future land use and development.

Those who are proactive, apply critical decision making, and consider issues such as tax rate and levy impacts as well as dollars required – on the front end – will reap the benefits from a “getting projects completed” perspective. They will also incite community pride, prosperity, and economic growth.

If you would like to discuss comprehensive planning, SEH will gladly make our community and economic development staff available to develop an approach unique to your community and designed for planning success.